Seamless Cross-Border Transactions

In today’s interconnected world, the need for reliable and efficient cross-border financial transactions has never been more critical. CactusPay emerges as a leading solution, providing a secure and user-friendly platform for individuals and businesses alike. This comprehensive blog post will delve into the reasons why CactusPay is the preferred choice for cross-border transfers and safe online banking.

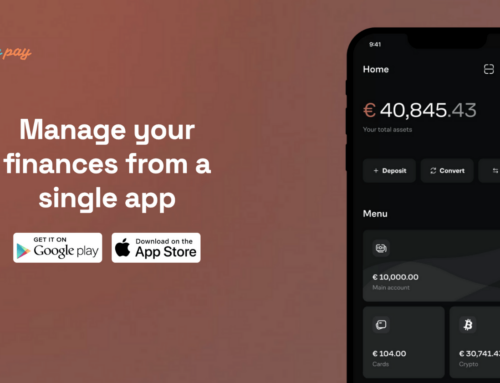

CactusPay: A Comprehensive Financial Solution

CactusPay offers a wide range of financial services, including:

- Personal Banking: Current accounts, virtual and physical debit cards, and international money transfers.

- Business Banking: Business accounts, SEPA withdrawals, and real-time customer support.

- Cryptocurrency Integration: Manage and trade cryptocurrencies directly from your CactusPay account.

Key Benefits of CactusPay

- Seamless Cross-Border Transfers:

- Multiple Currency Support: CactusPay supports a wide range of currencies, making it easy to send and receive money internationally.

- Low Fees and Fast Transfer Times: Enjoy competitive rates and quick transaction processing.

- Enhanced Security:

- Advanced Encryption: CactusPay employs state-of-the-art encryption technology to protect your financial data.

- Multi-Factor Authentication: Add an extra layer of security to your account with two-factor authentication.

- Real-Time Monitoring: CactusPay continuously monitors your account for suspicious activity.

- User-Friendly Interface:

- Intuitive Design: The CactusPay app and website are designed for easy navigation.

- 24/7 Customer Support: Get assistance whenever you need it.

CactusPay’s Role in the Cryptocurrency World

CactusPay is at the forefront of the cryptocurrency revolution, offering:

- Cryptocurrency Wallet: Store, send, and receive various cryptocurrencies directly within your CactusPay account.

- Secure Trading: Benefit from a secure and regulated environment for cryptocurrency trading.

- Integration with Traditional Finance: Easily convert between cryptocurrencies and fiat currencies.

Success Stories: Real-World Examples

- A French E-commerce Startup: CactusPay helped the company streamline its international payments and manage employee expenses.

- An Italian Freelancer: The freelancer used CactusPay to receive payments from clients worldwide and avoid high transaction fees.

- A Belgian Tech Company: The company leveraged CactusPay’s business banking features to improve its financial management.

The Growing Demand for Cross-Border Payments

The demand for cross-border payments is rapidly increasing, driven by globalization, technological advancements, and changing consumer preferences. Here are the key trends and challenges shaping this evolving landscape:

Key Trends

- Digital-First Solutions: Consumers are increasingly seeking instant and transparent payment options for cross-border transactions. Businesses are responding by adopting digital wallets and online payment platforms to enhance customer experience and meet these expectations.

- Real-Time Payments: The push for real-time payments is significant, with over 70 countries endorsing such systems. This trend aims to eliminate traditional delays in processing cross-border transactions, providing users with greater financial control and efficiency.

- Increased Global Payment Volumes: The global payments market is projected to grow from USD 190 trillion in 2023 to USD 290 trillion by 2030. This growth reflects the rising importance of cross-border payments in facilitating international trade and commerce.

- Technological Innovations: Advancements in technology, such as APIs and blockchain, are transforming cross-border payments by improving transparency, reducing costs, and enhancing transaction speed. These innovations enable financial institutions to offer more competitive and user-friendly services.

- Regulatory Changes: As the landscape evolves, regulatory frameworks are adapting to ensure consumer protection while facilitating smoother transactions. Initiatives like the G20 Roadmap aim to enhance the efficiency of cross-border payments through improved compliance and reduced costs.

CactusPay’s Competitive Advantage

CactusPay stands out from traditional banks and other online payment providers due to its innovative features and focus on customer satisfaction. Here are some key competitive advantages:

- Comprehensive Payment Solutions

- CactusPay offers an all-in-one platform that combines banking, payment processing, and card issuance. This contrasts with many competitors that focus on only one aspect, providing a more comprehensive solution for businesses.

- Borderless Transactions

- CactusPay facilitates seamless cross-border payments, allowing users to transact globally without complications. It supports multiple currencies and offers instant SEPA transfers and cryptocurrency payments, catering to diverse international needs.

- Unlimited Card Issuance

- Users can issue an unlimited number of physical and virtual cards, providing flexibility in managing employee expenses and separating personal/business spending. Many competitors limit card issuance or charge additional fees.

- High Transaction Limits

- CactusPay offers high limits on transactions and withdrawals, beneficial for businesses with significant cash flow needs. Traditional banks often impose stricter limits on international transactions.

- Transparent Pricing

- CactusPay emphasizes transparent pricing with no hidden fees, a common concern among payment gateway users. This approach contrasts with platforms that have monthly fees and additional transaction costs.

- 24/7 Customer Support

- CactusPay provides continuous real-time customer support, crucial for businesses requiring immediate assistance. The quality and availability of support can vary significantly among competitors.

- Crypto Integration

- CactusPay enables users to recharge accounts from cryptocurrency wallets, catering to the growing demand for digital currency management. This feature is not commonly offered by traditional payment solutions.

The Future of Cross-Border Payments

As technology continues to evolve, we can expect to see further advancements in cross-border payments. CactusPay is well-positioned to capitalize on these trends, with a focus on innovation and customer-centric solutions.

Understanding the Challenges of Cross-Border Transactions

Traditional methods of cross-border payments often involve complex procedures, high fees, and lengthy processing times. These challenges can be particularly burdensome for businesses and individuals who frequently transact internationally. CactusPay addresses these issues by providing a streamlined and efficient solution.

The Benefits of Using CactusPay for Cross-Border Payments

- Speed and Efficiency: CactusPay offers fast and reliable international money transfers, often within minutes.

- Cost-Effective: CactusPay’s competitive pricing helps businesses and individuals save money on cross-border transactions.

- Convenience: The user-friendly interface and mobile app make it easy to manage your finances on the go.

- Security: CactusPay employs advanced security measures to protect your financial data.

CactusPay’s Role in the Digital Economy

CactusPay is not only a convenient tool for cross-border payments but also a valuable asset in the digital economy. The platform’s integration with cryptocurrencies and other digital assets positions it as a leader in the fintech industry.

Case Studies: Real-World Examples of CactusPay’s Impact

- A Small Business Owner in France: “CactusPay has been a game-changer for my business. I used to spend hours dealing with international payments. Now, I can do it in a few clicks. The savings in time and money have been incredible.”

- A Freelancer in Italy: “As a freelancer working with clients around the world, CactusPay is indispensable. The platform’s low fees and fast transfer times have made my life much easier.”